THE continued adoption of digitalization and open fi nance in the Philippine banking industry is expected to transform the delivery of fi nancial services, enhance lenders' revenue-generation capabilities and boost economic growth.. Digitalization in the sector was accelerated when banks were forced to fi nd new ways of delivering fi nancial services to the public amid the mobility.. The Philippine banking industry has long been a cornerstone of the country's thriving economy, serving as a crucial catalyst for sustained growth. With the Central Bank of the Philippines, Bangko Sentral ng Pilipinas, overseeing the entire sector, the industry exhibits a diverse and segmented landscape that offers numerous opportunities for.

The French Banking Federation publishes The banking sector in 2017

Bank Compensation Consulting Pearl Meyer

Kstar Modular Data Center Solutions for Banking and Financial Institutions

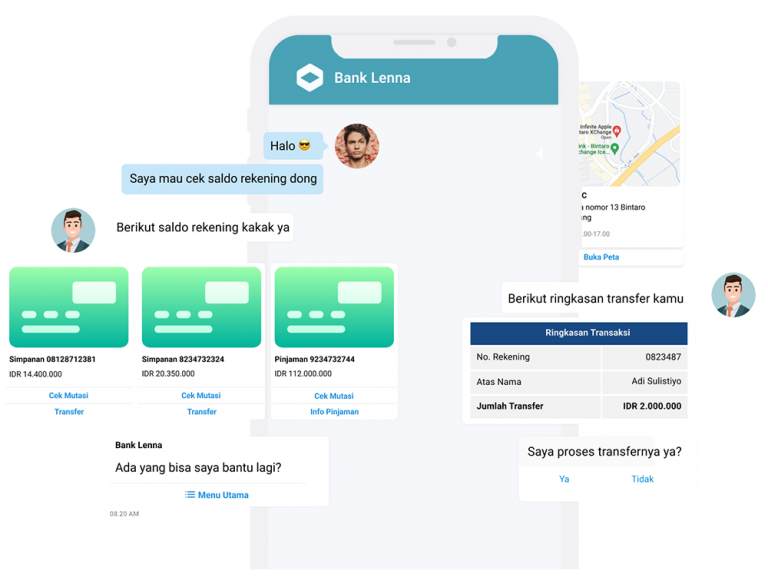

Banking Industry Lenna.ai

Banking industry trends 2016

Banking Industry Told to Wake Up Financial Tribune

Cannabis Companies Are Still Getting Help From Banks, Even Without the SAFE Banking Act The

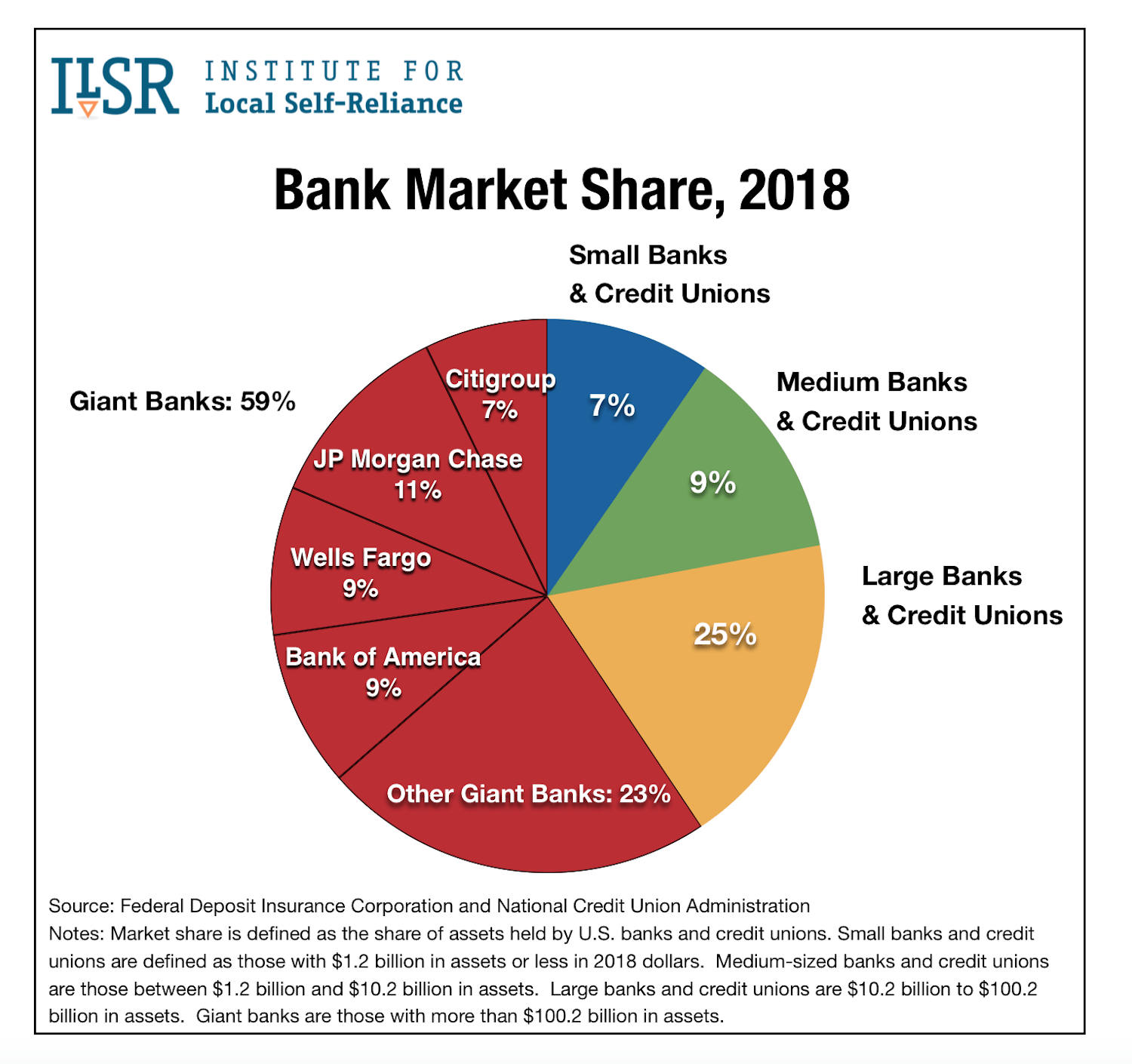

Bank Market Share by Size of Institution, 1994 to 2018 Institute for Local SelfReliance

Industry Banking

Banking as a Hospitality Industry Why Client Experience Matters

Blockchain in Banking How Blockchain is Reshaping the Banking Industry

Investment Banking Council of America (IBCA) offers world’s most prestigious credentials

JOHN DHEMET MANALO Philippines Propesyunal na Profile LinkedIn

Oregon Banking Industry Luncheon RMA Portland Metro

Big Data in Banking Industry How to new challenges

Banking Industry Checklist Nitel

Investment Banking Industry Size, Share & Industry Report

Banking Industry Sees Digital, Mobile Services Increase During Pandemic Huntsville Business

Top Challenges facing the Banking Industry in the Digital Age

Your Finance Formulas Will Payments Bank Ecosystem Disrupt Banking Industry?

Philippines' unmet banking needs. June 5, 2023 Banking revenue pools in the Philippines may triple by 2030, but 44 percent of the country's bankable population—those aged 15 and older—is considered unbanked. Senior partner Guillaume de Gantès and coauthors note the country's banking penetration rate is low compared with its peers and.. The bank is also very well-capitalized, giving it flexibility in growing its loan book and distributing dividends. Lastly, MBT is trading at a large discount vs peers at 0.7x P/BV (vs BDO - 1.3x and BPI - 1.3x) even after factoring in the difference in ROE (MBT - 12.9%; BDO - 16.1%; BPI - 15.1%). • • • Banking Industry 2024 Outlook: